|

The ACC Board recommended that the Government:

The Government:

Holding the Earners’ levy lower than the recommended rate means that higher levy increases will be required at the next levy round (4% to $1.26), all else being equal. Ultimately the levy needs to increase to meet new year costs (around $1.37 in 2021/23) as the funding position approaches the funding target. The accounts are subject to volatility including changes in claims experience and economic assumptions:

Overall, the Government’s decision to maintain the Earners’ Account levy does not have a large impact on future levies as the funding policy smooths the impact over ten-years. However, it is likely to result in a larger relative increase at the next levy round. |

From 1 April 2019 new regulations will come into force that set the levy rates for the Work Account and Earners’ Account for the next two years.

Sections 331(5A) and 331(5B) of the Accident Compensation Act 2001 (“Act”) require the Accident Compensation Corporation (ACC) to prepare a report in relation to the rates of levies prescribed in regulations in accordance with generally accepted practice within the insurance sector in New Zealand.

This report provides information about the expected long-term impacts of the 2019/21 levy rates for those Accounts and describes long-term projections of each Account’s finances along with key assumptions on which the projections are based. The Appendices provide further information about the levy setting process and the projections and assumptions that form the basis of this report.1

The levy rates discussed in this report are shown in Figure 1.

Unless otherwise stated, all rates in this report are expressed exclusive of GST.

Figure 1: Prescribed Levy Rates for 2019/21 for the Work and Earners’ Accounts

|

Work Account Average levy rate per $100 of liable earnings |

Earners’ Account Levy rate per $100 of liable earnings |

|

$0.67 |

$1.21 |

The Accident Compensation Scheme

ACC is a Crown agent providing comprehensive, no-fault personal injury cover to all New Zealand residents and visitors to New Zealand.

ACC cover is managed under five separate Accounts including the Work Account and the Earners’ Account. ACC collects levies to fund both these Accounts. Section 274 of the Act requires that revenue and expenditure for each Account must be accounted for separately.

The Work Account covers claims for all work-related injuries. The Work levy is paid by employers and self-employed people working in New Zealand and is expressed as a rate per $100 of liable earnings. The average levy, reported here, is the rate that all employers and self-employed people in New Zealand would pay if ACC charged a flat levy rate. The actual rate paid by each business differs from the average rate and is determined by the claims experience of its classification unit and individual business’ claims experience.

The Earners’ Account covers claims for non-work personal injuries for employed persons (including self-employed) not including motor vehicle injuries. The Earners’ levy is a flat rate paid by all employees and self-employed on their liable earnings up to a defined maximum and is expressed as a rate per $100 of liable earnings. It includes a component to fund earner claims in the Treatment Injury Account.

The Levy Setting Process

Levy rates are set every two years by the Government and enacted through regulations. Before the Minister for ACC can propose levy rates to Cabinet, he or she must receive and consider recommendations from ACC. ACC is required to consult with the public before making any recommendations to the Minister.

In addition to considering the submissions received during the consultation process ACC must follow the Government’s Funding Policy which sets out how ACC must balance the following three principles:

- Collecting the lifetime costs of injury claims in each levy year.

- Correcting surpluses or deficits in the accounts by lowering or raising future levy rates.

- Avoiding large changes in levies.

When accounts are in surplus, the costs of new injury claims can be met by either collecting levies or releasing some of the surplus funds. Conversely, when accounts are in deficit, levies above the cost of new injury claims are needed. A key aspect of the funding policy is that it requires ACC to recommend a slow release of surplus or deficit funds in order to mitigate large changes in levies. The Government can set levies that differ to what ACC must recommend under the funding policy.

The levy collected has no impact on the cost of claims managed by ACC. When surplus funds are released to offset claims costs, this does not address the fact that the underlying costs are increasing. If levies are not sufficient to cover claim costs, then eventually they will need to increase. The longer increases are delayed, the larger the expected levy increase is. Once surplus funds are exhausted, a significant increase to the levy rate may be needed to reflect the current claims costs.

It is also worth noting that the surplus or deficit position can move significantly with changes to economic conditions or claims experience.

Further information on the levy setting process is provided in Appendix A.

2018 Levy Consultation and Recommendations as at 30 June 2018

Following public consultation based on information and data to 30 June 2018, the Board recommended that the Government reduce the Work Account average levy by 7%, from $0.72 to $0.67 per $100 liable earnings for the 2019/21 levy period. Expected new-year claims costs have decreased, driven primarily by longer-term clients returning to independence faster than expected, and the removal of the loading required to fund the discontinued WSMP and WSD2 products.

The Board also recommended that the Government raise the Earners’ Account levy by 2.5%, from $1.21 to $1.24 per $100 liable earnings for the 2019/21 levy period. Expected new-year claims costs have increased, driven primarily by more clients receiving weekly compensation and increased costs due to the implementation of the pay equity legislation.

Both recommended rates were consistent with the funding policy (discussed in Appendix A). For the first time, the levy recommendations include the expected benefits of management actions in response to increasing costs. These include investments in injury prevention and the Integrated Change Investment Portfolio (ICIP). They reduce the levy required for Work and Earners’ by $78 million each year.

At the time recommendations and decisions were made by the Government, both accounts were in surplus and above the funding ratio target of 105%:

- Work Account – 117%

- Earners’ Account – 118%

In line with the funding policy, ACC’s levy recommendations included funding adjustments to take the accounts’ funding positions to the 105% funding ratio target, applied over a ten-year horizon.

Since that time, economic conditions have changed and the surpluses have reduced. This is covered in more detail later in the report.

Government Decisions and Projections

A. The Work Account

Cabinet agreed to the rates recommended by the Board, and the rates have now been prescribed in the Accident Compensation (Work Account Levies) Regulations 2019 using assumptions at 30 June 2018.

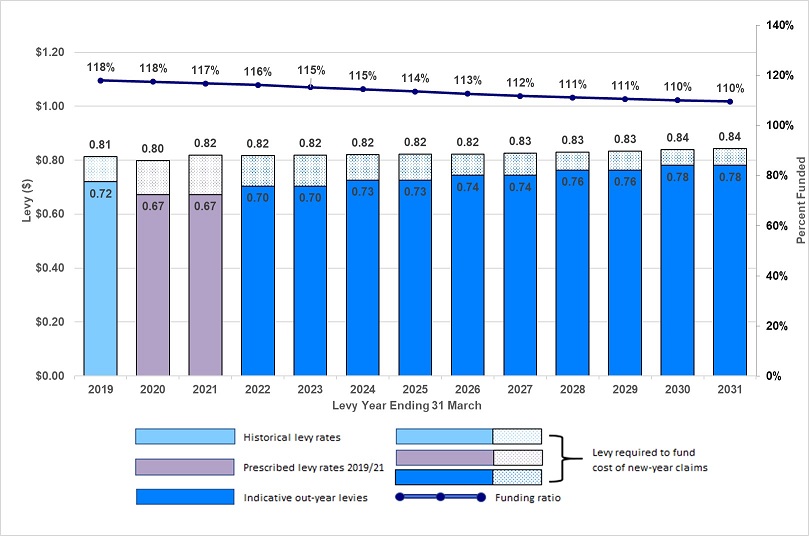

Levy rates have been set at a level below new-year claim costs. Based on the assumptions underlying the 2019/21 recommendation, this results in an expected deficit of $63 million for the levy period and reduces the expected funding ratio from 118% at 31 March 2019 to 117% by 31 March 2021. Indicative future levy rates, shown below, gradually move the Work Account’s funding ratio towards the funding target. These projections are based on information and data to 30 June 2018.

Figure 2: Long-term Projected Average Work Account Levy Rates and Funding Ratios (as at 30 June 2018) Allowing for Levy Rates Prescribed in the Accident Compensation (Work Account Levies) Regulations 2019 Using Assumptions at 30 June 2018

B. The Earners’ Account

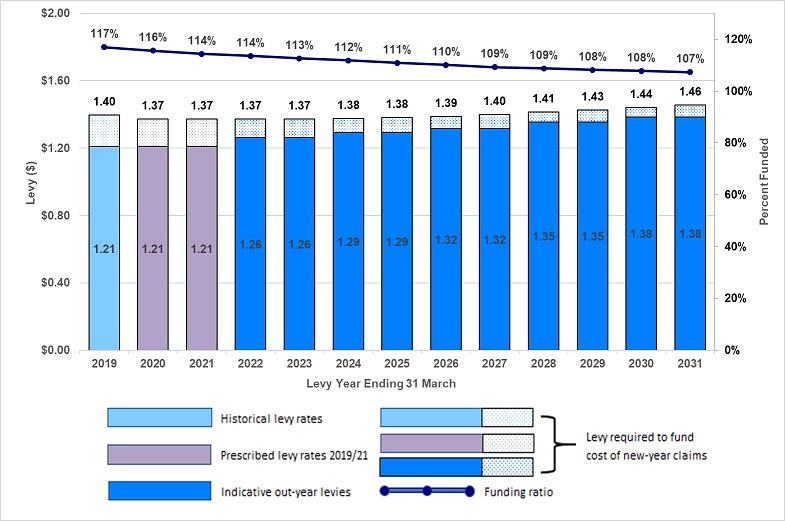

Cabinet decided to keep the rate unchanged at $1.21, and this rate has now been prescribed in the Accident Compensation (Earners’ Levy) Regulations 2019 using assumptions at 30 June 2018.

Levy rates have been set at a level below new-year claim costs. Based on the assumptions underlying the 2019/21 recommendation, this results in an expected deficit of $116 million for the levy period and reduces the expected funding ratio from 117% at 31 March 2019 to 114% by 31 March 2021. Indicative future levy rates, shown below, gradually move the Earners’ Account’s funding ratio towards the funding target. These projections are based on information and data to 30 June 2018, and allow for the prescribed 2019/21 levy rate.

The impact of Cabinet adopting a lower rate than that recommended by the Board, based on 30 June 2018 assumptions, is that over the next two years the funding position would move towards the target more quickly than specified by the funding policy. All else being equal, future levy rates will need to increase more quickly than would have otherwise been the case so that levy rates ultimately return to the level of new year claim costs. The funding policy smooths this change out, deferring the impact over future years. At 31 December 2018 the funding ratio had fallen and it is now expected that the funding ratio will fall below the funding target before the next levy consultation. This is discussed further in the next section.

Using the assumptions underlying the 2019/21 recommendation:

- if the recommended rate had been adopted, the levy rate in 2021/23 would have increased by 2% from $1.24 to $1.26; however

- given the prescribed rate, the underlying levy would increase by 4% from $1.21 to $1.26.

The increase required in levies next time, on 30 June 2018 assumptions, is more than double what it would have been under the funding policy. Any further delays in raising levies in line with the funding policy, or any further adverse claims or economic experience, would make the required increase larger again.

The actual 2021/23 levy rate recommendation will vary from these forecasts depending on claims and economic experience. After a projected initial adjustment for the lower expected 31 March 2021 solvency position, future levy rate increases are expected to be similar to those projected for the 2019/21 consultation, applying the funding policy.

Figure 3: Long-term Projected Earners’ Account Levy Rates and Funding Ratios (as at 30 June 2018) Allowing for the Levy Rate Prescribed in the Accident Compensation (Earners’ Levy) Regulations 2019 Using Assumptions at 30 June 2018

Changes Since 30 June 2018

Levy recommendations and decisions were made based on information, assumptions and forecasts as at 30 June 2018. Here we discuss material changes to the accounts after that date. At 31 December 2018, the funding ratios for both Accounts were lower than forecast using 30 June 2018 assumptions. The actual and expected funding ratios are shown in Figure 4 below.

Figure 4: Work and Earners’ Accounts—Expected and Actual Funding Ratios

|

Funding ratio (31 December 2018 as projected at 30 June 2018) |

Actual funding ratio (31 December 2018) |

|

|

Work Account |

118% |

112% |

|

Earners’ Account |

117% |

108% |

The reductions in the funding ratios have been driven by lower interest rates and an increase in the number of clients accessing weekly compensation.

As the levy rate is below new-year costs, it is expected that the funding ratio for the Earners’ Account will fall below the funding target before the next consultation.

The 2021/23 levies have been estimated using updated experience and economic assumptions to 31 December 2018. Based on this updated experience, there is no impact expected to the indicative Work Account levy rate in 2021/23 which is still expected to increase from $0.67 to $0.70. Indicatively, based on this experience:

- if the recommended rate had been adopted, the levy rate in 2021/23 would have increased by 5% from $1.24 to $1.30; however

- given the prescribed rate, the underlying levy would increase by 7% from $1.21 to $1.30.

These revised estimates have been made at a specific point in time. Actual funding ratios could deteriorate further, or improve, prior to the next levy round. This does however illustrate that the Accounts are volatile, and the lower the levy is set, the more exposed the Accounts are to this volatility. At some point, if levies are held too low, there is a risk that the levy rise required, to return to the underlying cost of new claims, becomes unreasonably high.

Conclusion

The Board recommended that the Government reduce the Work Account average levy by 7%, from $0.72 to $0.67. This was in line with the funding policy and was agreed to by Cabinet. Levies are expected to increase by 4% to $0.70 in 2021/23 under the funding policy.

The Board recommended that the Government raise the Earners’ Account levy by 2.5%, from $1.21 to $1.24. This was in line with the funding policy. Cabinet maintained the Earners’ Account levy at the current rate. The previous Government also chose to maintain the Earners’ levy against the recommendation of ACC. As a result, all else being equal, future recommended levy rates will be higher than would otherwise have been the case in order to meet the funding target set out in the funding policy. Recommended rates in the next levy round are expected to increase moderately (4% from $1.21 to $1.26), using the assumptions underlying the 2019/21 recommendation, and then increase at a lower rate over time. Ultimately the levy needs to increase to meet new year costs (around $1.37 in 2021/23) as the funding position approaches the funding target.

The accounts are subject to volatility including changes in claims experience and economic assumptions. The funding policy has been designed to smooth out changes by deferring the impact over future years.

Experience since 30 June 2018 has reduced the funding ratios. Starting from this lower position, the prescribed levy rate is expected to result in a further deterioration in the funding ratio and the Earners’ Account funding ratio is expected to fall below the funding target. This implies that larger levy increases (7% from $1.21 to $1.30) will be required than indicated above.

Overall, the Government’s decision to maintain the Earners’ Account levy does not have a large impact on future levies as the funding policy smooths the impact over ten-years. However, it is likely to result in a larger relative increase at the next levy round.

HERWIG RAUBAL, bec, fnzsa, fiaa, Chief Risk and Actuarial Officer, Accident Compensation Corporation.

Appendix A: Levy Setting Process

The Levy-Setting Process

Work and Earners’ Accounts’ levies are set by regulation under the authority of sections 167, 218, 219, 244, 329 and 333 of the Act.

ACC reviews the expected costs of the levied Accounts to determine the levy rates required to meet the lifetime cost of claims in the upcoming period, along with funding adjustments to move each Account towards its funding target. The ACC Board undertakes public consultation before recommending levy rates to the Minister for ACC.3 Cabinet sets the levy rates for the forthcoming levy period after considering the Board’s recommendations, along with the public interest as required by section 300 of the Act.

Principles of Financial Responsibility in Relation to the Levied Accounts

Section 166A of the Act requires the cost of all claims under the levied Accounts to be fully funded. To achieve full funding when setting levies, section 166A requires the Minister for ACC to have regard to the following principles:

- The levies derived for each levied Account should meet the lifetime costs of claims made during the levy year.

- If an Account has a deficit or surplus of funds to meet the costs of claims incurred in past periods, that surplus or deficit is to be corrected by setting levies at an appropriate level for subsequent years.

- Large changes in levies are to be avoided.

These principles provide guidance on how to balance the trade-off between funding stability and levy stability.

The Government’s Funding Policy

The funding policy issued by the Minister for ACC on 10 May 2016 (outlined below) specifies how ACC is to balance these principles when recommending levies for each levied Account. ACC must recommend levies for each levied Account consistent with the funding policy.

The funding policy requires that:

- Levy rates must be based on the estimated lifetime costs of claims expected to occur during the levy period (new-year claim costs);

- Accounts will aim to hold assets between 100% and 110% of the outstanding claims liability, with a midpoint funding ratio target of 105%;

- a funding adjustment must be included that takes each Account’s funding position to the 105% target smoothly over a 10-year horizon; and

- any increase to the levy rates for each Account must not exceed 15% (in addition to the Labour Cost Index (LCI) for the Motor Vehicle Account).

The funding policy is consistent with the principles in section 166A of the Act.

Variations in claims and economic experience are expected for a Scheme such as ACC. The ten-year horizon allows for a gradual return of an Account’s funding ratio towards the target and is expected to result in relatively small on-going changes in levy rates. A shorter horizon would result in a more rapid return to the target funding ratio, but also larger changes in levy rates.

Levy rates are recommended and set every two years. The effect of this is to reset the funding horizon every two years. All other things being equal, this will mean that an Account’s funding ratio will approach the target, but never fully arrive at it. As the funding ratio approaches the target, funding adjustments will decrease and levy rates will more closely reflect new-year claim costs.

The funding policy determines both how quickly the funding ratio approaches the funding target and the levy rate approaches new year claim costs. Any deviation from the funding policy changes the expected trajectory towards these targets.

In practice, experience will not exactly match what was assumed when recommending levy rates, and therefore levies are expected to vary around the best estimate forecasts shown in this report.

The levies recommended to the Minister by the Board for 2019/21, as well as those indicated for subsequent out-years, for both the Work Account and the Earners’ Account, were consistent with the funding policy.

Appendix B: Work Account

Work Account Long-Term Projections as at 30 June 2018

|

|

|

|

|

|

|

Levy required to fund lifetime costs |

|

|

|

Year ending 31 March |

Levy rates ($ per |

Levy ($m) |

Life time cost |

Administration costs for new- |

Management |

New-year claims |

Administration costs |

Levy savings from |

|

2019/20 |

0.67 |

708 |

699 |

208 |

-10 |

0.62 |

0.18 |

-0.01 |

|

2020/21 |

0.67 |

727 |

729 |

243 |

-17 |

0.62 |

0.21 |

-0.01 |

|

2021/22 |

0.70 |

788 |

759 |

253 |

-23 |

0.62 |

0.21 |

-0.02 |

|

2022/23 |

0.70 |

814 |

787 |

267 |

-30 |

0.63 |

0.21 |

-0.02 |

|

2023/24 |

0.73 |

868 |

817 |

279 |

-35 |

0.63 |

0.21 |

-0.03 |

|

2024/25 |

0.73 |

897 |

849 |

288 |

-39 |

0.63 |

0.21 |

-0.03 |

|

2025/26 |

0.74 |

949 |

880 |

297 |

-43 |

0.63 |

0.21 |

-0.03 |

|

2026/27 |

0.74 |

980 |

914 |

307 |

-45 |

0.64 |

0.21 |

-0.03 |

|

2027/28 |

0.76 |

1,037 |

949 |

318 |

-47 |

0.64 |

0.21 |

-0.03 |

|

2028/29 |

0.76 |

1,070 |

987 |

328 |

-49 |

0.65 |

0.22 |

-0.03 |

|

2029/30 |

0.78 |

1,131 |

1,026 |

339 |

-51 |

0.65 |

0.21 |

-0.03 |

|

2030/31 |

0.78 |

1,167 |

1,067 |

349 |

-53 |

0.66 |

0.21 |

-0.03 |

|

|

Levy Year Start |

|||

|

Year ending 31 March |

Accrued assets ($m) |

OCL*($m) |

Net assets (Accrued |

Funding Ratio |

|

2019/20 |

9,732 |

8,249 |

1,482 |

118% |

|

2020/21 |

9,814 |

8,350 |

1,465 |

118% |

|

2021/22 |

9,886 |

8,466 |

1,419 |

117% |

|

2022/23 |

9,997 |

8,603 |

1,394 |

116% |

|

2023/24 |

10,110 |

8,766 |

1,344 |

115% |

|

2024/25 |

10,251 |

8,949 |

1,302 |

115% |

|

2025/26 |

10,401 |

9,159 |

1,243 |

114% |

|

2026/27 |

10,586 |

9,391 |

1,195 |

113% |

|

2027/28 |

10,779 |

9,639 |

1,140 |

112% |

|

2028/29 |

11,014 |

9,900 |

1,114 |

111% |

|

2029/30 |

11,247 |

10,167 |

1,080 |

111% |

|

2030/31 |

11,507 |

10,447 |

1,061 |

110% |

*Outstanding Claims Liability

The tables above present the projected levy and funding path after applying the funding policy. The table below summarises the key assumptions underlying these projections.

Work Account Key Assumptions as at 30 June 2018

|

Year ending 31 March |

Claim Numbers |

Entitlement |

Exposure (Number of |

Exposure |

Investment |

Risk-free |

Standard |

|

2018/19 |

35,747 |

16.11 |

2,219 |

109 |

4.9% |

1.8% |

1.9% |

|

2019/20 |

36,766 |

16.27 |

2,260 |

113 |

3.8% |

1.9% |

1.9% |

|

2020/21 |

37,569 |

16.37 |

2,295 |

118 |

3.9% |

2.1% |

1.9% |

|

2021/22 |

38,244 |

16.48 |

2,321 |

122 |

4.0% |

2.5% |

1.9% |

|

2022/23 |

38,810 |

16.58 |

2,340 |

126 |

4.1% |

2.8% |

1.9% |

|

2023/24 |

39,380 |

16.69 |

2,360 |

130 |

4.3% |

3.1% |

1.9% |

|

2024/25 |

39,957 |

16.80 |

2,379 |

134 |

4.4% |

3.4% |

1.9% |

|

2025/26 |

40,537 |

16.91 |

2,398 |

139 |

4.5% |

3.5% |

1.9% |

|

2026/27 |

41,109 |

17.02 |

2,416 |

143 |

4.6% |

3.6% |

1.9% |

|

2027/28 |

41,680 |

17.13 |

2,433 |

148 |

4.8% |

3.7% |

1.9% |

|

2028/29 |

42,239 |

17.24 |

2,450 |

153 |

4.9% |

3.7% |

1.9% |

|

2029/30 |

42,795 |

17.36 |

2,466 |

158 |

4.9% |

3.7% |

1.9% |

|

2030/31 |

43,345 |

17.47 |

2,481 |

163 |

4.9% |

3.8% |

1.9% |

*Accredited Employer Programme (AEP)

The following table compares the components of the 2019/21 prescribed average levy rate with those of the 2017/19 rate and previously indicated 2019/21 rate. The first column shows the components of the 2017/19 prescribed levy rate. The second column shows the indicated 2019/21 levy rate based on the assumptions used in the previous levy consultation and given the rate prescribed for 2017/19. The third column shows the updated levy rate, following the funding policy, recommended by the Board for 2019/21. The fourth column shows the components of the levy rate prescribed for 2019/21.

Work Account Levy Components as at 30 June 2018

|

Trend in underlying costs |

Prescribed 2017/19 levy rate |

Previous levy indication 2019/21 |

Recommended 2019/21 levy rate |

Prescribed 2019/21 levy rate |

|

To fund the cost of new claims during the new levy year (excluding admin costs) |

$0.67 |

$0.68 |

$0.62 |

$0.62 |

|

To fund administration costs |

$0.26 |

$0.27 |

$0.20 |

$0.20 |

|

Management Responses |

$0.00 |

$0.00 |

-$0.01 |

-$0.01 |

|

Funding adjustment |

-$0.21 |

-$0.18 |

-$0.13 |

-$0.13 |

|

Average Work levy rate |

$0.72 |

$0.77 |

$0.67 |

$0.67 |

Appendix C: Earners’ Account

Earners’ Account Long-Term Projections as at 30 June 2018

|

Earners' Account and the earners’ portion of Treatment Injury Account |

|

Levy required to fund lifetime costs |

|

|||||

|

Year ending 31 March |

Levy rates ($ per |

Levy ($m) |

Life time cost |

Administration costs |

Management |

New-year claims |

Administration |

Levy savings from |

|

2019/20 |

1.21 |

1,712 |

1,746 |

251 |

-49 |

1.23 |

0.18 |

-0.03 |

|

2020/21 |

1.21 |

1,780 |

1,836 |

261 |

-70 |

1.24 |

0.18 |

-0.05 |

|

2021/22 |

1.26 |

1,921 |

1,923 |

266 |

-92 |

1.26 |

0.17 |

-0.06 |

|

2022/23 |

1.26 |

1,985 |

2,005 |

273 |

-109 |

1.27 |

0.17 |

-0.07 |

|

2023/24 |

1.29 |

2,098 |

2,089 |

280 |

-123 |

1.28 |

0.17 |

-0.08 |

|

2024/25 |

1.29 |

2,168 |

2,180 |

286 |

-135 |

1.29 |

0.17 |

-0.08 |

|

2025/26 |

1.32 |

2,289 |

2,268 |

293 |

-144 |

1.30 |

0.17 |

-0.08 |

|

2026/27 |

1.32 |

2,364 |

2,365 |

300 |

-149 |

1.32 |

0.17 |

-0.08 |

|

2027/28 |

1.35 |

2,501 |

2,466 |

309 |

-153 |

1.33 |

0.17 |

-0.08 |

|

2028/29 |

1.35 |

2,581 |

2,574 |

317 |

-158 |

1.34 |

0.17 |

-0.08 |

|

2029/30 |

1.38 |

2,731 |

2,687 |

325 |

-162 |

1.36 |

0.16 |

-0.08 |

|

2030/31 |

1.38 |

2,819 |

2,805 |

333 |

-167 |

1.37 |

0.16 |

-0.08 |

|

|

Earners’ Account only (levy year start) |

|||

|

Year ending 31 March |

Accrued assets ($m) |

OCL*($m) |

Net assets (Accrued |

Funding Ratio |

|

2019/20 |

10,271 |

8,782 |

1,489 |

117% |

|

2020/21 |

10,622 |

9,186 |

1,436 |

116% |

|

2021/22 |

10,978 |

9,604 |

1,373 |

114% |

|

2022/23 |

11,404 |

10,043 |

1,360 |

114% |

|

2023/24 |

11,837 |

10,511 |

1,326 |

113% |

|

2024/25 |

12,309 |

11,008 |

1,301 |

112% |

|

2025/26 |

12,789 |

11,538 |

1,251 |

111% |

|

2026/27 |

13,320 |

12,100 |

1,220 |

110% |

|

2027/28 |

13,856 |

12,687 |

1,169 |

109% |

|

2028/29 |

14,459 |

13,297 |

1,162 |

109% |

|

2029/30 |

15,057 |

13,923 |

1,134 |

108% |

|

2030/31 |

15,707 |

14,570 |

1,136 |

108% |

*Outstanding Claims Liability

The tables above present the projected levy and funding path after applying the funding policy. The table below summarises the key assumptions underlying these projections.

Earners’ Account Key Assumptions as at 30 June 2018

|

Year ending 31 March |

Claim Numbers |

Entitlement |

Exposure |

Exposure |

Investment |

Risk-free |

Standard |

|

2018/19 |

64,893 |

25.25 |

2,570 |

136 |

5.5% |

1.8% |

1.9% |

|

2019/20 |

66,884 |

25.56 |

2,617 |

142 |

4.2% |

1.9% |

1.9% |

|

2020/21 |

68,924 |

25.94 |

2,657 |

148 |

4.3% |

2.1% |

1.9% |

|

2021/22 |

70,561 |

26.25 |

2,688 |

153 |

4.5% |

2.5% |

1.9% |

|

2022/23 |

71,601 |

26.41 |

2,711 |

158 |

4.6% |

2.8% |

1.9% |

|

2023/24 |

72,524 |

26.53 |

2,733 |

163 |

4.7% |

3.1% |

1.9% |

|

2024/25 |

73,455 |

26.66 |

2,756 |

169 |

4.8% |

3.4% |

1.9% |

|

2025/26 |

74,387 |

26.78 |

2,778 |

174 |

4.9% |

3.5% |

1.9% |

|

2026/27 |

75,304 |

26.91 |

2,799 |

180 |

5.0% |

3.6% |

1.9% |

|

2027/28 |

76,210 |

27.04 |

2,819 |

186 |

5.2% |

3.7% |

1.9% |

|

2028/29 |

77,094 |

27.17 |

2,838 |

191 |

5.2% |

3.7% |

1.9% |

|

2029/30 |

77,963 |

27.30 |

2,856 |

198 |

5.2% |

3.7% |

1.9% |

|

2030/31 |

78,821 |

27.43 |

2,874 |

204 |

5.2% |

3.8% |

1.9% |

The following table compares the components of the 2019/21 prescribed average levy rate with those of the 2017/19 rate and previously indicated 2019/21 rate. The first column shows the components of the 2017/19 prescribed levy rate. The second column shows the indicated 2019/21 levy rate based on the assumptions used in the previous levy consultation and given the rate prescribed for 2017/19. The third column shows the updated levy rate, following the funding policy, recommended by the Board for 2019/21. The fourth column shows the components of the levy rate prescribed for 2019/21.

Earners’ Account Levy Components as at 30 June 2018

|

Trend in Underlying Costs |

Prescribed |

Previous levy |

Recommended |

Prescribed |

|

Earners’ portion only: |

|

|

|

|

|

To fund the cost of new claims during the new levy year (excluding admin costs) |

$1.11 |

$1.14 |

$1.14 |

$1.14 |

|

To fund administration costs |

$0.18 |

$0.18 |

$0.16 |

$0.16 |

|

Management Responses |

$0.00 |

$0.00 |

-$0.04 |

-$0.04 |

|

Funding adjustment |

-$0.19 |

-$0.11 |

-$0.09 |

-$0.10 |

|

Earners’ portion of Treatment Injury: |

|

|

|

|

|

To fund the cost of new claims during the new levy year and administration costs |

$0.12 |

$0.12 |

$0.10 |

$0.10 |

|

Funding adjustment |

-$0.01 |

-$0.01 |

-$0.04 |

-$0.05 |

|

Total Earners’ levy rate |

$1.21 |

$1.32 |

$1.24 |

$1.21 |

Appendix D: Explanatory Notes

Funding Adjustment

This is the adjustment to levy rates which is used to move the funding ratio of an Account towards the funding target. The impact of funding adjustments is that levy rates will be higher or lower than the level needed to fund the cost of new-year claim costs (including administration costs).

Funding Ratio

The funding ratio is the ratio of each Account’s assets to liabilities. It is a measure of whether the Accounts have sufficient assets to meet the outstanding claims liability. Solvency is another term for funding ratio.

The funding ratios in this report differ to those reported in the Annual Report. When calculating levy rates, the funding ratios exclude the Unexpired Risk Liability (URL) as this doesn’t reflect the funding positions’ economic reality.

The liability for incurred but not reported work-related gradual process disease and infection claims is included when calculating the Work Account funding ratio. The liability for these claims is not included in the Annual Report due to accounting requirements.

Funding Target

The funding ratio target is 105%. This is the midpoint of the funding band of 100% to 110%.

Investment Returns

The expected returns are based on current strategic asset allocations and are consistent with ACC’s long-term expected returns for the various asset classes that make up the total investment reserves. They allow for ACC’s tax status.

Labour Cost Index

The Labour Cost Index (LCI) measures changes in salary and wage rates for a fixed quantity and quality of labour input.

New-Year Claim Costs

Claims that occur during a new levy year. New-year claim costs are the net present value of the estimated lifetime cost of those claims, including expenses.

Outstanding Claims Liability

The Outstanding Claims Liability (OCL) is an actuarial estimate of net present value of all future costs for accidents that have already happened including an allowance for claims incurred but not reported, and re-opened claims.

Risk-free Interest Rates

The risk-free interest rate is the theoretical rate of return of an investment with zero risk. It represents the nominal return an investor would expect from an absolutely risk-free investment over a given period of time.

Notes

1. Additional information can be found in the Work and Earners’ Accounts 2019/21 Pricing Reports for Consultation, which are available on request from ACC.

2. Workplace Safety Management Programme (WSMP) and Workplace Safety Discount (WSD).

3. ACC’s levy consultation website is https://www.shapeyouracc.co.nz/. Consultation relating to the 2019/21 levy period took place between 27 September 2018 and 25 October 2018.

Gazette.govt.nz

Gazette.govt.nz